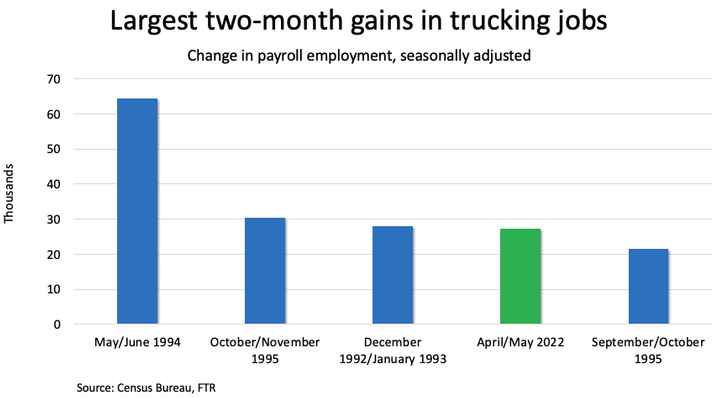

According to the Bureau of Labor Statistics, the trucking industry added 27,300 jobs in April and May of this year. This is the fourth largest gain in over 30 years of trucking industry data. Will this trend continue, and how will it affect staffing at trucking companies? In a recent article published by Heavy Duty Trucking, Avery Vise, vice president of transportation for FTR Transportation Intelligence, offered some insight into this hiring market.

Areas that appear to be on the downturn may just be adjusting to the market. Single truck carriers continue to leave the market. However, these drivers aren’t leaving the industry. Instead, they’re seeking the stability of a larger company in a market with volatile rates and fuel costs. Likewise, the softening dry van and refrigerated market is more a reflection of the shift to contract shipping, not a decrease in shipping volume.

Equipment supplies continue to be a problem. While the backlog of trucking orders is far behind the 2021 peak, it’s still about as high as it was in December of 2018. Today, it takes around 10 months for a truck order to be filled. However, actual lead times are longer due to restricted ordering. Manufacturers are hesitant to take more orders when they aren’t sure when they can deliver trucks to customers.

Large trucking companies are hesitant to buy used trucks to fill the supply gap, due to increased maintenance costs and the complications of added repairs. Some companies may look at hiring former independent carriers as leased owner-operators. However, this model is on its way out after the Supreme Court refused to hear a review of California’s AB5 law. Under this law, truck drivers must be seen as employees, not contractors.

Owner-operators also aren’t keen on leasing to large companies, due to the delay between paying for fuel and being reimbursed. Rising diesel prices are already stressing the finances of drivers, and this delay doesn’t do anything to alleviate the problem. Instead, we may see a new business model that functions in reverse of a lease-purchase agreement. The carrier buys the operator’s truck, and hires the operator to drive it. This allows the driver to use company resources to pay for fuel directly, and avoids violating AB5 in California.